In the market for a new credit card processing company?

The devil is in the details — specifically the fees.

Hidden fees are some of the biggest concerns for small business owners:

- Client booking fees (which Schedulicity doesn’t have)

- Annual or subscription fees

- Transaction fees

In fact, credit card processing is one of the biggest offenders.

If you’re considering signing up for a new payment processor or making the switch from your current one, you’re probably curious about if you found the best deal.

That’s why we’re breaking down some of the most common payment processors along with some of the lesser-known options (many of which offer as-good or better rates — like our own payment processor!), so you can make the decision with a clear head and conscience.

How This Comparison Chart Works

(Or just skip straight to the chart)

The Payment Processors We Looked At

How We Organized

For the sake of your sanity, we summarized the payment processors with the best and worst option(s) at the start of each section, then broken down the details in a chart below.

Beyond standard processing fees, we also compared:

- If processing equipment is complimentary

- Contract requirements

- Hidden fees / costs

- Easy access to customer support

- Next-day funding

Acknowledgment of Bias

This article was written by the Schedulicity team, which offers built-in payment processing. We are absolutely biased towards our own payment processor because we’re so dang proud of it.

That said…

We love and respect small business owners, so we believe in:

- Honest reporting

- Transparency

- Helping you make the right decision for you by presenting all the facts

This payment processor comparison chart is meant to do just that.

One Final Caveat

We updated these comparisons in October 2021 and check and revise them every few months. That said, some data may be outdated between revisions. (We’re only human!)

For the most accurate details, check the pricing pages of each payment processor.

You can find links to all of the pricing and fees pages for each of the payment processors (i.e. the data sources we shared here) at the end of this article.

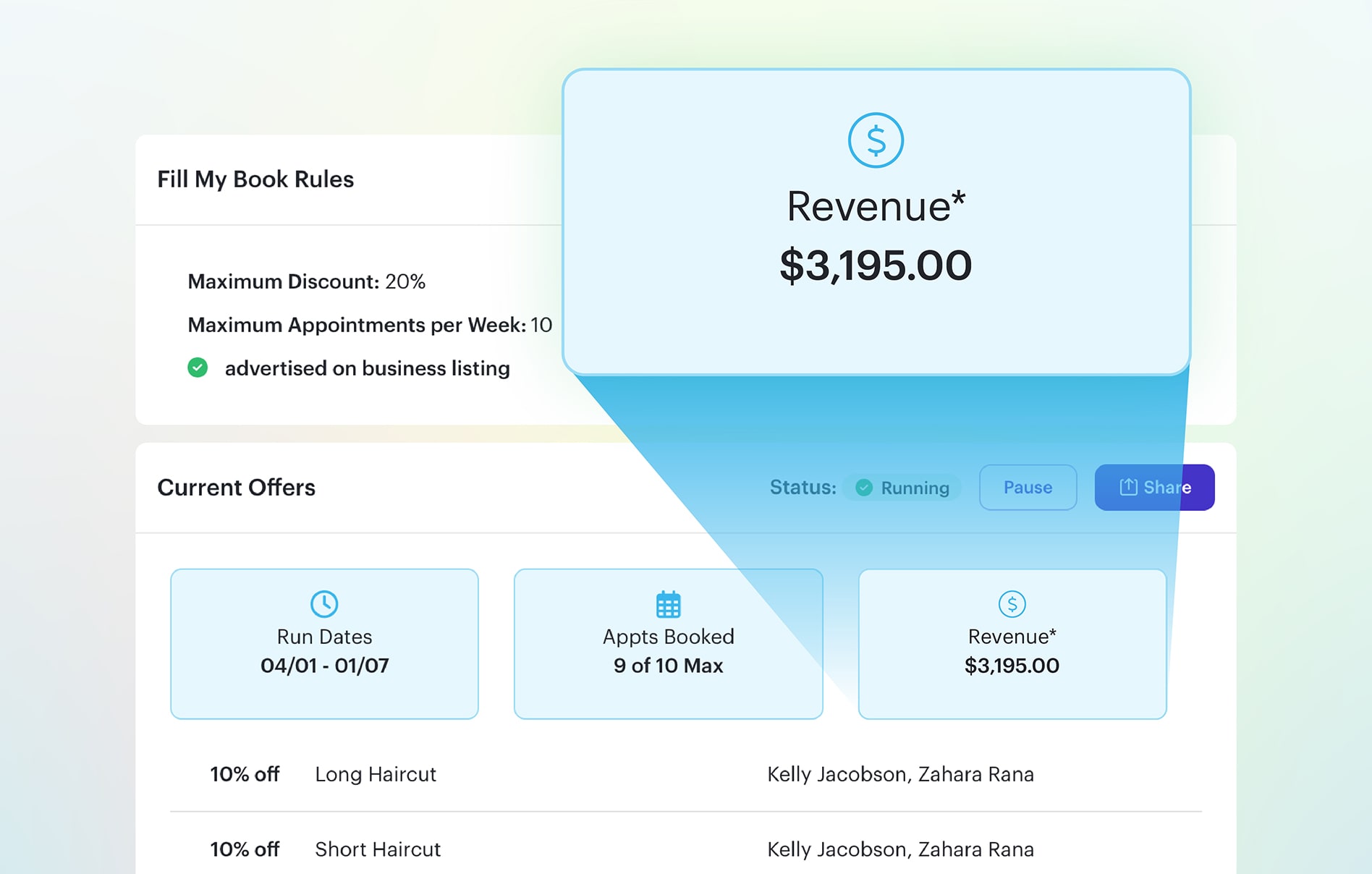

How to Make More Money in 8 Weeks

We’re officially changing the conversation around money. Let’s talk growth.

Learn MoreCredit Card Payment Processors: Comparison Chart

1. Processing Fees

The cost for credit card transactions (i.e. “swipe, dip, tap”). Note that some processors have separate fees for in-person transactions. We included those details in our full table breakdown.

Schedulicity with One Rate. 2.6% + $0.10 for all transactions. No additional fees for card-not-present transactions, which is most of what you’re likely doing anyway.

- Shopify. 2.9% + $29 a month for Shopify (lower rates if you pay a higher monthly premium)

- Stripe. 2.9% + $0.30 for Stripe

- PayPal. 2.9% + a fixed fee for PayPal

- (Maybe) Square. 3.5% + 15¢ to charge cards on file — which is a common practice for service providers.

| Stripe | 2.9% + $0.30 (additional fees / rates apply for other processing, including terminal and recurring billing) | |

| PayPal | Online transactions: 2.9%, plus a fixed fee based on currency (for the U.S., it’s + $0.30). In-store transactions: 2.7%. | |

| Shopify | Tiers: 2.4% + 30¢ + $299 per month, 2.6% + 30¢ + $79 per month, 2.9% + 30¢ + $29 per month. | |

| Mindbody | 2.75% (qualified), 3.5% + $0.15 (non-qualified) and a $15 monthly minimum fee applies if you process less than $550/month. | |

| Vagaro | 2.75% for “small businesses”, i.e. any business processing less than $4,000 per month. | |

| Square | 2.6% + 10¢ (contactless/swipe/dip) – 3.5% + 15¢ (cards on file) | |

| QuickBooks | 2.4% swiped, 2.9% invoiced, 3.4% keyed-in + 25¢ per transaction. | |

| Schedulicity | 2.6% + $0.10 for every type of transaction. | |

2. Additional Costs for Card Readers

Some companies either sell businesses their card readers or POS systems or charge a rental fee.

Lowest: Schedulicity and Vagaro. With Schedulicity, you don’t need a card reader. Our newest contactless payment solution, lets clients pay and tip straight from their phones. That means no more buggy devices ever.

Vagaro, meanwhile, offers free card readers.

Highest: Paypal and Stripe. PayPal’s reader will set you back almost $100. Stripe offers a more affordable $49 option, but its highest-priced reader costs $299.

| Stripe | $59-$299 for readers (to use them you’ll pay the increased terminal rate of 2.7 + $0.05). | |

| PayPal | $99.99 for the PayPal payment chip reader. | |

| Shopify | Buy a “retail kit” for $219 or a tap and dip card reader for $49. | |

| Mindbody | $40-$119 for card readers. | |

| Vagaro | Free card reader provided, POS systems starting at $74. | |

| Square | Free magstripe reader, $49 for a contactless & chip reader. | |

| QuickBooks | $19-49 for card readers. | |

| Schedulicity | $84 for a mobile card reader and $460 for a desktop card reader. | |

3. Hidden Fees / Costs

Some credit card processors add fees behind the scenes, which you don’t always catch unless you read the small (small!) print.

While this isn’t as quantitative as other details, we broke down some possible pricing ~gray~ areas below.

Transparent fees: Schedulicity. With our new One Rate, clients can pay however they like for 3% + $0.15 per transaction every time. That comes with available next-day funding.

Harder to figure out: Shopify, PayPal, and Stripe. Good luck.

| Stripe | Additional fees for international cards. | |

| PayPal | Additional fees for international cards. | |

| Shopify | You’ll need to do some careful calculations to determine which plan is the most cost-effective for you. | |

| Mindbody | No. | |

| Vagaro | No. | |

| Square | No. | |

| QuickBooks | No. | |

| Schedulicity | None. | |

4. Contract / Subscription Requirements

Are you require to commit to a set period of time using this payment processor?

What happens if you decide to leave before that period is over?

Breaking a contract, or getting stuck paying higher rates than you’d like for longer than you expect, can affect your bottom line. (Budgeting is key after all!)

No contract: Every platform but Mindbody allows businesses to cancel at their convenience.

Contract required: Mindbody has “subscription terms”.

It’s unclear from Mindbody’s site how long these subscriptions last. In its terms and conditions, Mindbody includes the following: YOU ARE RESPONSIBLE FOR ALL SUBSCRIPTION FEES FOR THE ENTIRE SUBSCRIPTION TERM.

| Stripe | No. | |

| PayPal | No. | |

| Shopify | No. | |

| Mindbody | Subscription terms. | |

| Vagaro | No. | |

| Square | No. | |

| QuickBooks | No. | |

| Schedulicity | Nope. | |

5. Live Customer Support

Let’s face it: Whether it’s faulty WiFi or human error, lots can go wrong with payment processing.

That’s why it’s essential that there’s a great support team behind your credit card payment processor.

Best customer support: Schedulicity. We’re known for our fantastic human support. (Read the reviews here… and here… and here.)

Our dedicated payment team works with you any time you receive a chargeback notification — hugely important when you’re a small business.

Here are some additional notes about the little-known perks of Schedulicity’s built-in payments.

Worst customer support: Subjective. Stripe charges $1,800 per month for “Premium Support”.

Shopify limits live support to only its higher tier monthly plans.

Other payment platforms make it difficult to reach a person, pushing you to their documentation and support articles first.

| Stripe | 24/7 phone, chat, and email support. | |

| PayPal | Phone support available. | |

| Shopify | Only for the higher tier monthly plans. | |

| Mindbody | Yes. | |

| Vagaro | Yes. | |

| Square | Yes. | |

| QuickBooks | Some phone support. | |

| Schedulicity | Yes, our full-time customer support team is available to you via phone and email. | |

6. Next-Day Funding

You want your payment F-A-S-T. Here’s how various credit card payment processors stack up.

| Stripe | Offers an “instant payout” option for an additional fee. | |

| PayPal | Offers an instant transfer option for an additional fee. | |

| Shopify | Yes. | |

| Mindbody | No. | |

| Vagaro | No, but Vagaro promises payments within 24-48 hours. | |

| Square | Yes. | |

| QuickBooks | Yes. | |

| Schedulicity | No. | |

7. Independent Payment Processing

Is this payment processor a separate account you can sync with other business platforms?

Are you required to sign up for an account with, say, an online scheduler? (Note: This is how we do it at Schedulicity.)

Both these approaches have their pros and cons, but it’s good to know before you pick.

Just a payment processor: Stripe, PayPal, Shopify, Square, and Quickbooks.

Connected to another platform (such as online scheduling): Mindbody, Schedulicity, and Vagaro.

See how Schedulicity stacks up against Vagaro, or check out the best Mindbody alternatives.

| Stripe | Yes. | |

| PayPal | Yes. | |

| Shopify | Yes. | |

| Mindbody | No, you’ll need a Mindbody account. | |

| Vagaro | No, you’ll sign up for a Vagaro account, which includes appointment booking. | |

| Square | Yes. | |

| QuickBooks | Yes. | |

| Schedulicity | You’ll need a Schedulicity business account, which also gives you access to appointment and class booking! | |

8. Conclusion

Best-of-All-Worlds Option: Schedulicity

If you’re a service-based business and interested in seamless payment processing, Schedulicity really is the most affordable in your industry.

We did this, because we know how quickly fees can affect a small business’ budget.

As a Schedulicity user, you have instant access to all our booking and marketing tools. Adding Schedulicity’s built-in payment processing is the cherry on top.

It means that you can run the entire process from a new client first booking to checkout (including selling products) from one account.

Curious to learn more?

Here’s an article breaking down why we’re the cheapest credit card payment processor in the biz, plus additional details about Schedulicity’s payment tools.

Comparison Chart Sources and Additional Information

| Stripe | stripe.com |

| PayPal | paypal.com |

| Shopify | shopify.com |

| Mindbody | mindbodyonline.com |

| Vagaro | vagaro.com |

| Square | squareup.com |

| QuickBooks | quickbooks.intuit.com |

| Schedulicity | schedulicity.com |

“I’ve been a loyal Square customer for years, but Schedulicity supports small businesses in ways no other companies has, and that’s exactly why I’m switching. The customer service is amazing.” —Alexandra, Esthetician